Message from the CEO

Selection and concentration

of business to break from past

traditions and return to a

growth trajectory

Toshimitsu Taiko

Director, President and CEO, Representative

Executive Officer

Reflection on progressRecording impairment loss to confront risks now

and provide a clean slate

Fiscal 2022 marks both the final year of the DX2022 Medium-term Business Plan and a year of record consolidated Group revenue, at ¥1,130.3 billion and a jump of 24% over the previous fiscal year. This marks our highest revenue since the 2003 integration that formed Konica Minolta as it exists today. However, amidst this success and a steady recovery of our business contribution profit* (measuring earning power) to ¥29.7 billion, we elected to post a significant impairment loss of ¥116.6 billion, driving our operating profit and profit attributable to owners of the Company into the red, at ¥95.1 billion and ¥103.1 billion, respectively. When viewed in isolation,these are undeniably severe results.

In closing our accounts for fiscal 2022, we tested several acquired assets, including technology assets, goodwill and other intangible assets, and fixed assets, for impairment in line with International Financial Reporting Standards (IFRS). This impairment testing resulted in a determination that it would be difficult to recover investments within originally expected timeframes in several business areas, including precision medicine. We therefore decided to process these as impairment losses so as not to postpone inevitable risks.

Another challenging decision that was made this year, in light of a total examination of our performance this fiscal year and the importance of investing in future business given the environment and the prospects therein, we have elected to suspend the payment of a year-end dividend for fiscal 2022, resulting in solely the ¥10 per share interim dividend for the fiscal year in total. I offer my sincerest apologies for this suspension of standard dividend

payment. However, in light of this decision not to pay a year-end dividend, we have elected to voluntarily return a portion of executive compensation paid to executive officers as defined by Japan’s Companies Act.

* Business contribution profit is a Konica Minolta-original index, defined as profit determined by subtracting sales cost and SG&A from revenue.

Despite falling short of targets, we have made

three years of progress toward future growth

In the three fiscal years from 2020 to 2022, we have toiled to enhance our profitability and solidify our financial soundness per the direction of DX2022, our Medium-term Business Plan. Despite our best efforts, however, we ultimately failed to achieve any of the financial targets set therein, referring specifically to operating profit, operating profit ratio, equity ratio, and net Debt/EBITDA ratio. We particularly note that we still face challenges in three units defined as new strategic businesses that posted greater losses: precision medicine, DW-DX, and imaging-IoT solutions.

Even in our office business, traditionally a business with stable profits, we continued to face struggles due to a number of factors, including a prolonged COVID-19 pandemic, the global shortage of semiconductors, and a reduced toner supply capacity due to the accident at the Konica Minolta Supplies Manufacturing Tatsuno Factory.

Still, despite these troubles, we were able to achieve significant improvements in profits during fiscal 2022 by increasing production capacity and curbing the rise in fixed costs through structural reforms. Another positive note is the three years of profit growth nearly in line with targets in our other focus pillars of sensing, IJ (inkjet) components, production print, and medical imaging (healthcare).

Therefore, when we view the DX2022 three-year period from the lens of individual businesses, we can see results generated that will lead us to future success. Looking ahead to fiscal 2023, the first year of our new Medium-term Business Plan, we view these results as a major driving force and underlying foundation supporting new actions and further growth.

Regaining trust and confidence in fiscal 2022

Since assuming the post of President in 2022, I have sought to rebuild the trust with stakeholders both external and internal as well as the confidence of our employees.

Therefore, in fiscal 2022 I worked with utmost priority to restore Konica Minolta to profitability. With the exception of fiscal 2022, the Company has for many years set lofty annual goals at the outset that were dependent on the best possible conditions being in place. What is especially important in our new approach with respect to employee confidence is that our fiscal 2022 goals were tempered to represent a place we could reach if we all worked hard together, even without the best possible conditions and with absorbing some potential downsides. Achieving these goals was meant to remind Konica Minolta employees of our winning ways, and particularly to re-embolden them by turning a profit after a series of net losses since fiscal 2019.

I believe the truth is in the field—in the factories, offices, and all other places, in Japan and abroad, where our colleagues deliver Konica Minolta excellence. In order to convey my desire to rebuild confidence to my colleagues, I have spent a great deal of time meeting with nearly 5,000 Company employees around the world, listening to their concerns and discussing how we should move forward.

While our diligent work together makes it especially frustrating that we could not bring Konica Minolta back to the black by the end of fiscal 2022, there is no doubt in my mind that our Group’s earning power is steadily recovering. This is evident in our business contribution profit (a unique Konica Minolta measure of earning power) for fiscal 2022 of ¥29.7 billion, jumping more than ¥40 billion from a loss of ¥12.2 billion in fiscal 2021. Not only that, but if we exclude the aforementioned impairment losses, operating profit was ¥21.5 billion, well exceeding the initial plan of ¥15 billion.

There is one more insight I would like to relay from my time traveling between sites in Japan and abroad in the last year. Spending this time on the front lines has reminded me of how well some of our Group businesses are steadily generating profits, even if they may not be so obvious in a summarized annual report. My time also revealed a great deal of new technologies and talented colleagues I had not taken notice of before, something that has helped reform some of our new business policies and aided our ability to deploy best practices to other businesses. Though these revelations did not directly allow us to turn a profit in fiscal 2022, they underpin our determination in the coming year.

Future outlookSelection and concentration of business at the core

of our new Medium-term Business Plan

We are entering a new Medium-term Business Plan period as of fiscal 2023 (see page 18 for details). The most fundamental of our priority policies in this plan is strengthening our balance sheet and ability to generate cash flow to extract ourselves from our present deficit. This policy is paired with a key focus on selection, concentration, and structural reforms in our businesses so as to establish a foundation for growth toward fiscal 2025 and beyond.

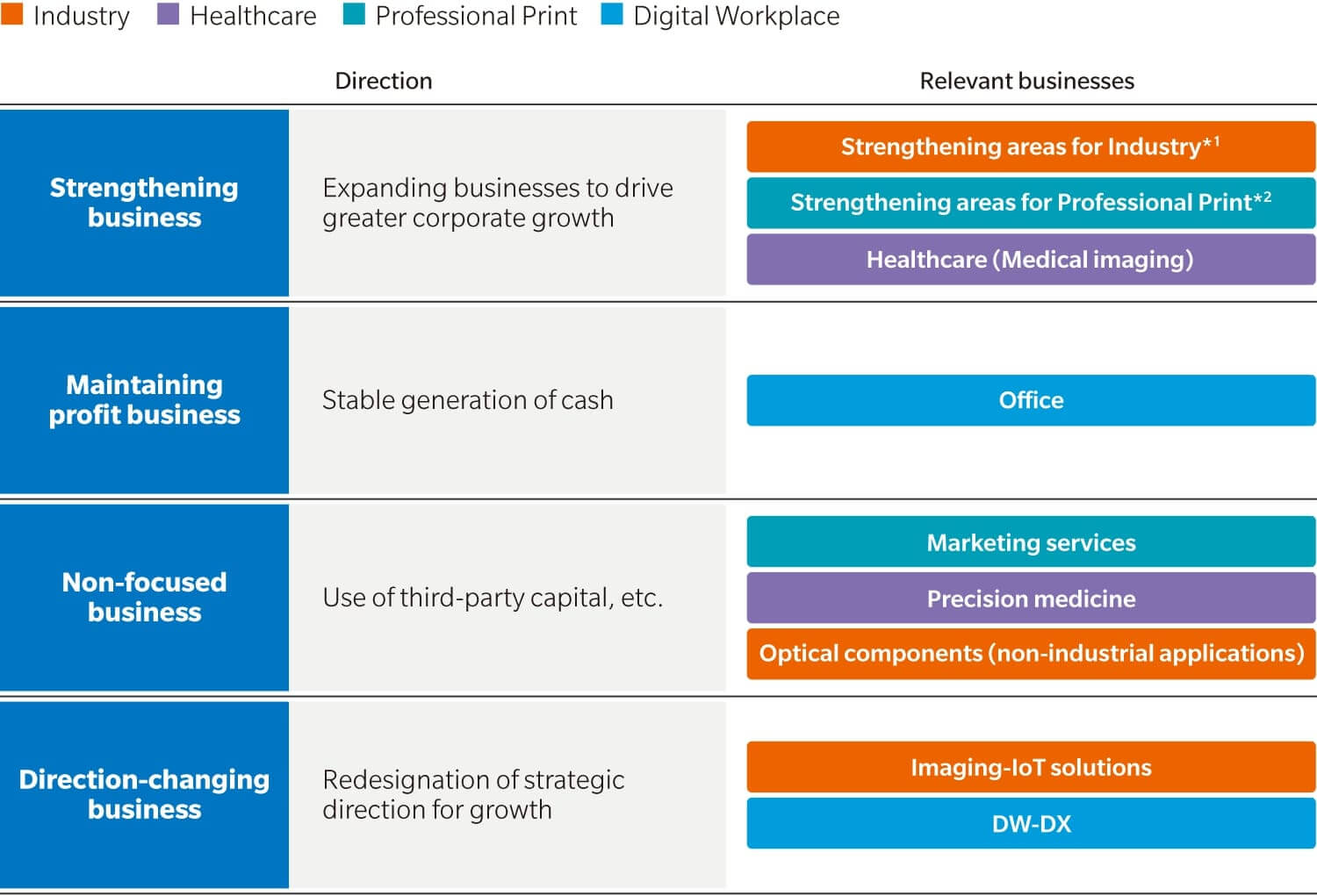

In the selection and concentration of business, we have recategorized all businesses to fit in one of the following four categories: strengthening businesses, maintaining profit businesses, non-focused businesses,and direction-changing businesses. This new categorization is designed to allow us to clearly indicate the roles and responsibilities of each business and the criteria for re-allocating resources to or from each, whereas our previous quadrant-based matrix was part of an omnidirectional growth policy.

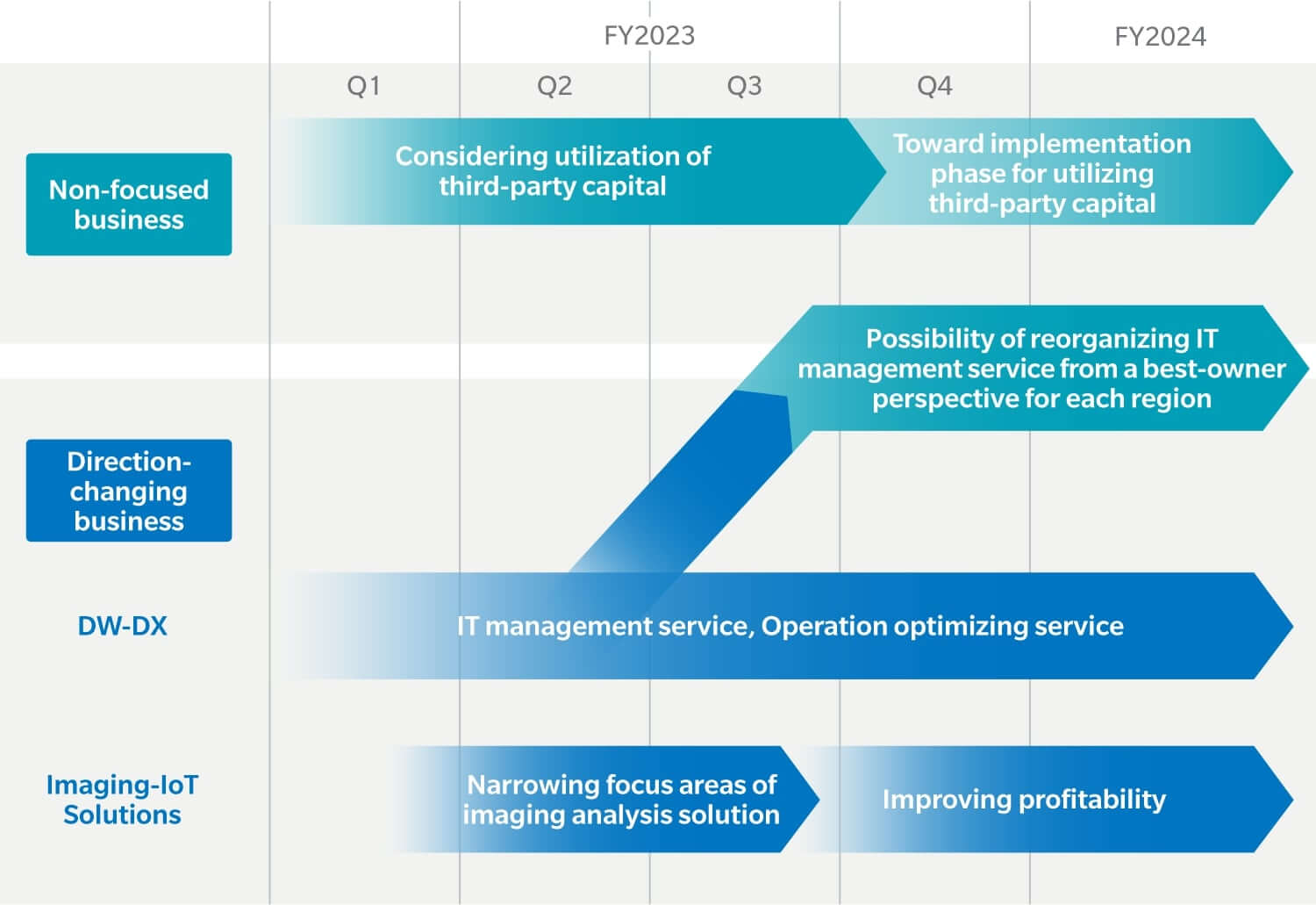

What is most important to note here is that the new strategic businesses, as defined in the previous Medium-term Business Plan, have been reclassified to either nonfocused businesses or direction-changing businesses since they have not been keeping up with the growth strategies laid out for them. More specifically, our precision medicine business, despite its presence in a promising growth field with significant potential contribution to society, has been classified as a non-focused business. Furthermore, an assessment of its compatibility with our growth strategy and the need for additional investment has resulted in a move to consider methods to raise third-party capital to support the business, including potential business transfer to another entity and/or public listing on a U.S. equity market. In addition, we decided to remove our domestic subsidiary within the marketing services business from the scope of consolidation in April 2023 through a third-party joint venture agreement.

Two businesses have been classified as directionchanging businesses: DW-DX and imaging-IoT solutions. Within DW-DX are our operation optimizing services and IT management businesses. We are examining potential regional changes in the latter, including as a best possible owner, given its limited synergy with our office business and development resources. As for imaging-IoT solutions, we will narrow our focus areas in image analysis solutions to outdoor and thermal utilization areas in Europe and North America. Through these activities in both businesses, we are accelerating our work toward greater overall profitability.

Business positioning in the new Medium-term Business Plan

*1 Strengthening areas for Industry: Sensing, performance materials, IJ components, and optical components (industrial applications)

*2 Strengthening areas for Professional Print: Production print and Industrial print

Milestones: non-focused and direction-changing businesses

Driving growth through priority resource

allocation to strengthening businesses

Our Industry, Professional Print, and medical imaging businesses have been defined as strengthening businesses, which are to drive growth for the Group. In order to facilitate their role in our growth, we will focus our management resources in these areas to continue building strengths from the previous Medium-term Business Plan period and achieve further growth in revenue and profits.

Within the particularly profitable Industry Business, we are working to expand our business and achieve crossdomain technology synergies in a number of domains for strengthening, including sensing, performance materials, IJ components, and optical components. In growth areas such as displays, mobility, and semiconductor manufacturing, we believe that we can generate business that is more closely tied to our customers by maximizing our relationships with each and our technological assets across the entire business. We have already launched a dedicated organization for this purpose in April 2023, which is practicing cross-functional activities to achieve our goals in this area (see page 49 for details).

In the Professional Print Business, the digital printing market is enjoying steady expansion in both commercial and industrial applications as the pool of available skilled technicians shrinks around the world and as customers become increasingly mindful of the environment. Thanks to these favorable conditions, we are able to utilize our extensive network of contact, not only with printing companies but also with those ordering printed materials

(brand owners), logistics companies, and other sites throughout the printing supply chain, to help customers go digital in their processes, providing additional value in automation, labor savings, and remote operations (see page 55 for details).

So too does the medical imaging business offer greater business opportunities going forward, and we will aim to capture this and achieve growth with a focus on high-value-added imaging and IT solutions, built on the foundations of our brand power and firm customer base cultivated since the days of X-ray films (see page 53 for details).

On the other hand, we must consider the accelerating shift away from printing as to how it affects our office business, classified as a maintaining profit business in the new Medium-term Business Plan. This more rapid shift, accelerated beyond the gradual pace we anticipated by the COVID-19 pandemic, has forced us to assess the impact on this business from the shift to hybrid remote-office work systems going forward. Understanding this, we are working to restructure our business model in this area to ensure a certain profit level and cash flow even if print volume declines through broader use of our unique billing model, transformation in our sales and service operations, and reducing manufacturing costs (see page 57 for details).

Utmost focus on ROE for maximum corporate value

Our new Medium-term Businesses Plan adopts an approach of challenging and achievable management, establishing achievable plans incorporating a balance of risks and opportunities.

For our financial targets, these plans include Company-wide targets to achieve revenue of ¥1.2 trillion, business contribution profit ratio of 5% or more, and ROE of 5% or more in fiscal 2025.

While we do not intend to significantly grow our revenue in and of itself, we are planning to make significant changes to its composition. We expect a gradual decline in sales from the office business and given this we will expand our high-margin strengthening businesses, boosting their revenue to ¥500 billion by fiscal 2025 and making their share of total business contribution profit around 75%, thereby improving the profitability of the entire Company (see page 20 for details).

Among our financial targets in the Medium-term Business Plan, we are placing our utmost focus on ROE in the interest of maximizing corporate value. Given that we have recorded a loss attributable to the owners of the Company for the past several years, our priority is indeed to return to profitability in fiscal 2023, but within this priority, we see ROE of 5% or more, our fiscal 2025 target, as the bare minimum. We will work to achieve the 5% level as soon as possible and work to reach an 8% ROE at an early stage within the next Medium-term Business Plan period at the latest.

In order to improve ROE, we believe it is necessary to go beyond revenue and profits to also improve financial soundness. Our targets in this area include a total asset turnover ratio of 1.0 and financial leverage of 2.0 times. To ensure a more effective policy, we have decided to incorporate ROE with a significant 80% weighting in evaluations for medium-term stock bonus for Directors and Executive Officers, which are linked to performance (see page 69 for details).

As for the future outlook in our new Medium-term Business Plan, the first year’s performance is an area of great interest for us. In fiscal 2023, ¥18 billion is our operating profit target, and this is the absolute minimum level we need to achieve, even if there are some changes in the environment around us. The key will be how far we can exceed this level. Overall, we are committed first to achieving a return to profitability, a goal we did not achieve in fiscal 2022, to restore confidence to the Group as a whole, and then to aim for a new growth trajectory.

Furthermore, we are working to enhance our cash generation ability and offer more robust dividends and other shareholder returns.

Sustainability at the heart of management

Since the 2003 management integration that created the Konica Minolta of today, sustainability has been at the heart of the Group’s management. In 2020, when we envisioned what society would be like a decade later in 2030, we used this illustration to backcast and identify five material issues for the Group. Though there is an urgent need to restore our performance in the challenging business environment we face today, our management policy remains unchanged: we will aim to enhance our corporate value over the medium-to long-term by contributing to solving social issues through our business activities based on the aforementioned five material issues.

Revenue

ROE

Business contribution profit

In fiscal 2022, we established new environmental targets for addressing climate change, one of our material issues. Even before that and in advance of our peers, we established a bold target of reaching Carbon Minus status by fiscal 2030 in fiscal 2017, and have even moved forward this target’s achievement year to fiscal 2025. Carbon Minus refers to the state of using our businesses to help reduce CO2 emitted not only by us but also by our customers and society as a whole across Scopes 1, 2, and 3, and the goal of thereby reaching negative total CO2 emissions. We will achieve this, and simultaneously grow our earnings,through unprecedented work to pitch the emissionsreducing environmental value of our office, Professional Print, and other businesses. Also, we have set a target to achieve Net Zero CO2 emissions across Scopes 1, 2, and 3 by fiscal 2050, and we are accelerating reductions in Konica Minolta product lifecycles. Separately, with regard to the material issue of using limited resources effectively, we have set a new target of reducing natural resource use in our products by 90% from fiscal 2019 levels by fiscal 2050, and have been taking measures to achieve the target (see page 25 for details).

One element not yet mentioned that is absolutely essential for sustainable corporate growth is human capital. Even the very best high-level strategies are nothing without the employees on the frontlines who actually implement them and make them work, and we are therefore committed to supporting and uplifting our talent to instill passion and pride in their work. Our global employee survey will absorb employee feedback for driving greater organizational capability, with a goal of achieving the industry average employee engagement score of 7.7 in fiscal 2025, and reaching the top 25% of industry peers in fiscal 2030 (see page 41 for details).

In order for our management to more profoundly commit to addressing climate change, and supporting and uplifting human capital, we have incorporated our CO2 emissions reduction rate and employee engagement score in evaluations for medium-term stock bonuses (performance-linked) for Directors and Executive Officers as of fiscal 2023 (see page 69 for details). This will help make our officers more mindful not only of ROE and other financial targets, but also building greater non-financial capital, and will lead to further enhancement of corporate value.

Holding our new course toward reestablishing steady growth

Since assuming office as President, I have always been mindful of the need to engage in forward-looking discussions to pave the way for the future, and at the same time, to be resolute and make cool, collected decisions in the interest of the company’s future based on the facts of the matter rather than be shackled by historic precedent.

In my discussions with our executive management, I have asked them to also break with the past, focusing on building an organization with the dynamism to be resilient and adaptable in the face of environmental changes.

Our work to make the Board of Directors a place that fosters frank, interactive discussions, including not only our regular monthly meetings but also informal open discussions in the form of roundtable meetings, is also part of this effort. These environmental changes have resulted in more profound and preemptive discussions among board members, including outside directors, and consequently the raising of several helpful suggestions as to the Group’s management. Discussions were especially insightful in shaping the decision to adjusting management policies in the new Medium-term Business Plan, as well as in record an impairment loss for fiscal 2022.

Fiscal 2023 marks not only the first year of our new Medium-term Business Plan, but also the 150th anniversary of our company’s founding and the 20th anniversary of our management integration. My aim is to make this year one that is remembered as a major turning point toward a new beginning for Konica Minolta, and I am fully committed to using our past reflections and learning for the betterment of our management and steadily returning us to a growth trajectory under the guidance of the new Medium-term Business Plan.

As we take these steps forward, I humbly ask for your ongoing support and understanding, whether shareholder,investor, customer, or employee.